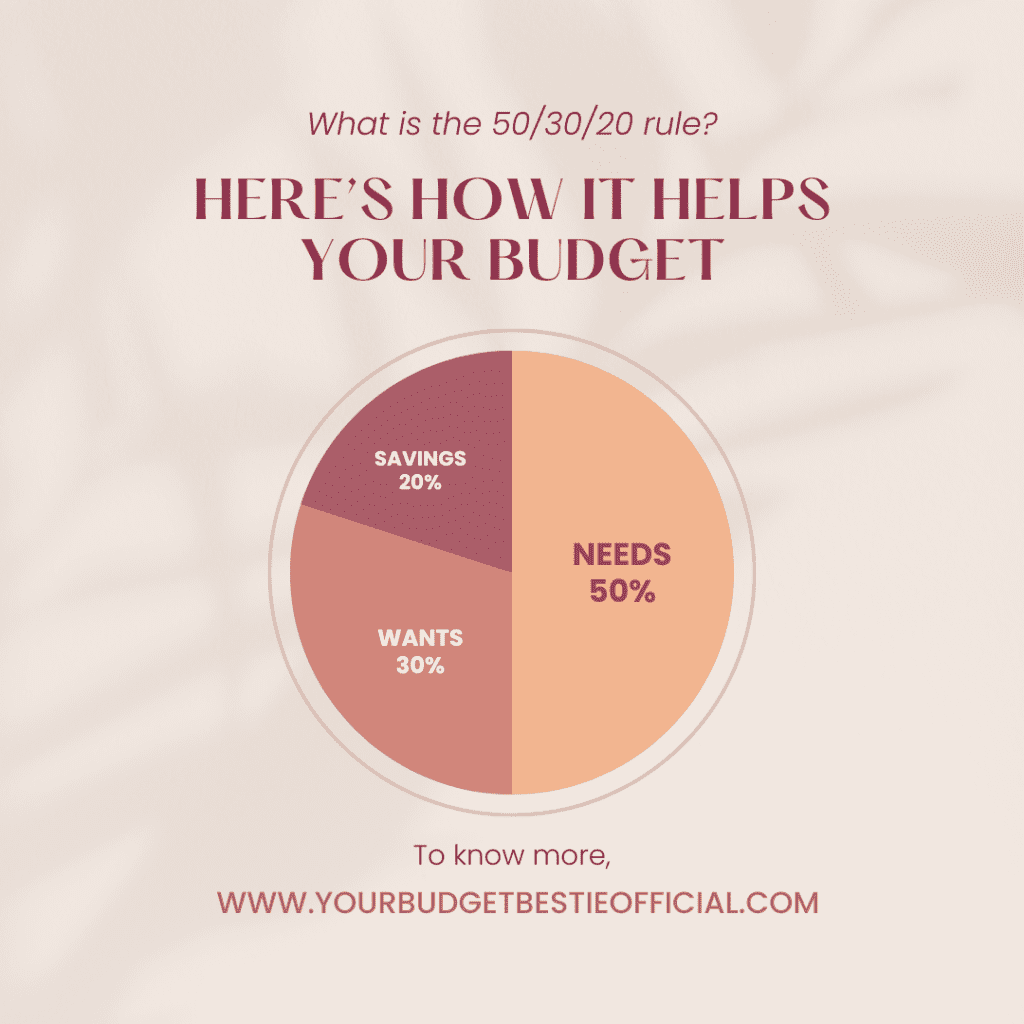

50/30/20 Rule for Budgeting

The 50/30/20 rule divides your expenses into three categories. It is a guide for how much money you should be using for each.

Take a look at your gross income (before taxes). Take your total amount less taxes that are withheld like SS, state, and federal. Do not deduct healthcare costs even if they are automatically taken from your paycheck. Health care costs will become part of your total budget.

If you have high interest debt, such as credit cards, try the 50/20/30 rule budget. Spend less on your wants and put more towards your savings category to pay down your debt faster.

Needs: 50%

About half of your budget should be going towards needs that must be met each month no matter what. If you can’t live with out something, it might belong in this portion of the budget.

Many people put their car payment under needs but evaluate if the car you have was a need or a want? Did you need to buy the car you have or was a cheaper car a better financial decision for you? If you are driving a high end car, your car payment might make more sense split between two categories if you chose to go with a higher end car instead of basic care because you wanted certain luxuries or a brand name.

Examples include:

- Utility bills, phone, and internet

- Rent or mortgage payments

- Health care costs

- Food & Groceries

- Transportation

- Car Insurance, Maintenance, and Gas

- Minimum Loan Payments

- Child Care Costs

Wants: 30%

Knowing what belongs under needs and wants is not always easy and varies from one budget to another. Generally speaking, wants are the extras that you can live with out. These aren’t essential for living and working. Often they’re for fun things and might include:

- Monthly Subscriptions

- Traveling

- Entertainment

- Eating out

- Gifts

- Cable TV

- Donations

- Makeup and Hair Products

- Home Décor

- Clothes and shoes

Savings: 20%

Savings is what you plan to save for the future. If you have existing debt, this portion of your budget should first be put towards paying down existing debt. You can’t out invest high interest debt! After you have your high interest debt paid off, then you can create a financial safety net for what makes sense to you.

- Additional credit card payments

- Saving for a new car

- Student loans

- College Savings

- Retirement Savings, 401(k), Roth IRAs

- Investments

Try the 50/30/20 Rule Budget calculator below and compare to your monthly expenses.

The 50/30/20 budget provides a straightforward framework for managing your finances, ensuring that you prioritize both your immediate needs and long-term financial goals while allowing some flexibility for discretionary spending. However, it’s important to adjust this framework to suit your individual circumstances and financial priorities.

What if my needs are more than 50% of my budget?

If your essential needs consume more than 50% of your budget, it’s an indication that you may be facing financial strain or living in a high-cost area. Here are some steps you can take to address this situation:

- Evaluate Your Expenses: Take a close look at your spending to identify areas where you may be able to reduce costs. Look for opportunities to trim expenses on utilities, groceries, transportation, and other essential needs. Consider alternatives such as meal planning to save on food costs, using public transportation to reduce commuting expenses, trading in your vehicle for something more affordable, or turning down the heat a couple of degrees.

- Increase Income: Explore opportunities to increase your income, such as seeking a higher-paying job, taking on additional work or freelance gigs, or pursuing opportunities for career advancement. Don’t be afraid to ask for a raise! Bring proof to your employer why you think you deserve one. Increasing your income can help you better afford your essential needs without sacrificing other financial goals.

- Prioritize Needs: If you’re unable to reduce your essential expenses below 50% of your budget immediately, prioritize the most critical needs and focus on covering those first. This may involve making sacrifices in other areas of your budget temporarily until you can improve your financial situation.

- Seek Financial Assistance: Depending on your circumstances, you may qualify for financial assistance programs or support services to help alleviate some of the financial burden. Explore options such as government assistance programs, food banks, housing assistance, or utility assistance programs.

- Consider Housing Alternatives: Housing costs are often one of the biggest expenses for individuals and families. If your housing costs are consuming a significant portion of your budget, consider alternatives such as downsizing to a smaller home or apartment, finding a roommate to share expenses, or exploring housing assistance programs.

- Create a Debt Repayment Plan: If debt payments are contributing to your high essential expenses, develop a plan to pay down debt more quickly. Consider strategies such as debt consolidation, a 0% Interest Balance transfer Credit Card, negotiating lower interest rates with creditors, or seeking assistance from a credit counseling service.

- Reassess Your Financial Goals: In some cases, it may be necessary to reassess your financial goals and adjust your budget accordingly. Determine which goals are most important to you and prioritize them based on your current financial situation.

Remember that addressing high essential expenses may take time and require patience and persistence. It’s essential to remain proactive and committed to improving your financial situation over the long term.

If you have any questions, leave them in the comments and I’ll be happy to help!

For more information on budgeting, check out our other posts here. Did you find you need more income to cover your expenses, check out this article about side hustles that can help you bring in additional money as early as this week.

Your Budget Bestie